Starlink is catching the world’s attention—and fast. It promises to bring fast internet to every corner of the globe using thousands of tiny satellites in space. This isn’t just big news for tech lovers—it’s creating serious buzz in the world of investing. People are asking if Starlink will become the next huge opportunity in the stock market. Some say it could be as game-changing as Tesla was when it first took off.

Now the big question is: “Is Starlink stock a good investment?” Before you start dreaming about profits, it’s important to know what Starlink is really doing, how it earns money, and when it might hit the stock exchange. The answers might surprise you—and help you make a smarter decision.

What Is Starlink? Understanding the Business Model

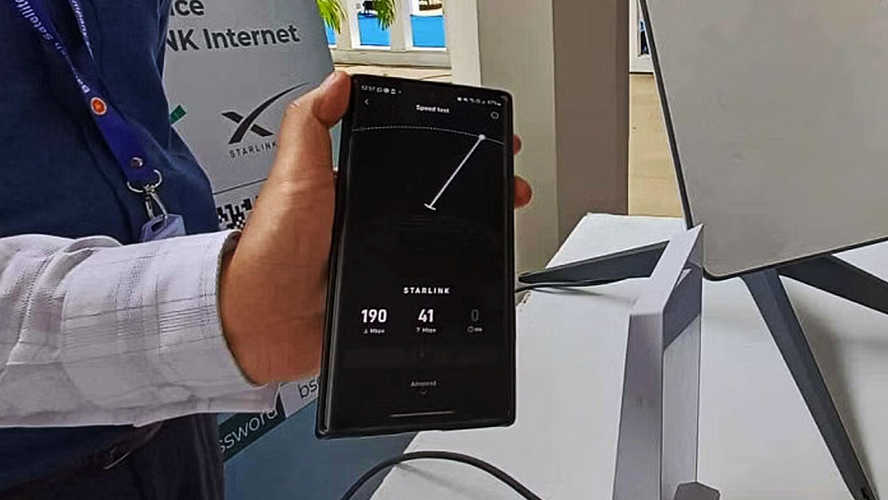

Starlink is a cutting-edge satellite internet service developed by SpaceX, the private aerospace company led by Elon Musk. Unlike traditional internet providers that rely on cables and towers, Starlink uses thousands of satellites in low Earth orbit (LEO) to beam internet down to users anywhere on Earth. Its biggest goal? To bring fast and reliable internet to places where regular connections are too slow, unreliable, or completely unavailable.

How It Works: A Simple Breakdown

- Satellite Network: Starlink currently has over 5,000 active satellites orbiting Earth, forming a powerful space-based network. These satellites are closer to the Earth than traditional ones, allowing for much faster data transfer.

- User Terminals: Customers receive a satellite dish and modem kit, which connects directly to Starlink’s network in space. The dish—playfully called “Dishy McFlatface”—automatically aligns with satellites overhead for the best connection.

- Monthly Subscription Plans: Users pay a monthly fee, usually ranging from $50 to $120, depending on location. This creates a recurring revenue stream, much like Netflix or other subscription-based services.

Starlink’s business model is unique because it combines telecommunications, space technology, and a direct-to-consumer model. It doesn’t rely on local infrastructure like cell towers or underground fiber, which gives it a major advantage in rural areas, war zones, disaster zones, and developing countries. Plus, SpaceX’s ability to build and launch its own satellites keeps costs lower and expansion faster than any competitor.

By blending innovation in spaceflight, hardware manufacturing, and broadband services, Starlink is not just another internet provider—it’s a global solution to one of the internet age’s biggest challenges: universal access.

The Vision Behind Starlink: Elon Musk’s Long-Term Goals

Elon Musk doesn’t just want to provide internet—he wants to rebuild how the world connects. Starlink is more than a tech project; it’s part of a huge master plan that ties into everything Musk is building with SpaceX. At its core, Starlink is designed to become a massive revenue stream that supports SpaceX’s boldest dream: sending humans to Mars. Musk believes that once fully developed, Starlink could generate over $30 billion in yearly revenue—far more than SpaceX’s rocket-launching business.

Key Goals Driving Starlink’s Mission

- Global Internet Coverage: The primary goal is to bring high-speed internet to every part of the planet, including remote and underserved regions where traditional networks can’t reach.

- Funding Mars Colonization: Musk has openly stated that income from Starlink will help fund the development of Mars rockets, life-support systems, and permanent space settlements.

- Powering Future Technologies: Starlink could also serve as the backbone for next-generation 6G wireless networks, autonomous vehicles, and real-time data services.

- Military and Emergency Use: Starlink already supports military and humanitarian missions, offering secure, fast internet in war zones and disaster-hit areas where other systems fail.

This bold vision offers exciting opportunities, but it also brings high expectations and potential risks. Elon Musk is known for juggling multiple ventures—from Tesla and Neuralink to The Boring Company. That creates challenges in focus and resource allocation. Still, if even part of his vision becomes reality, Starlink could shape the future of both Earth and space.

Market Demand for Satellite Internet: Is There Room to Grow?

The world is more connected than ever—but millions of people still live without stable internet. That’s where satellite services come in. Traditional providers can’t always reach rural or remote places because of high costs and tough terrain. Satellite internet skips the cables and towers, delivering access straight from space. It’s a game-changer for global communication, education, and emergency services.

The demand isn’t just big—it’s growing fast across different industries. In 2025 alone, satellite internet is already becoming a key player in global tech and telecom markets.

Global Market Highlights (2025)

| Segment | Estimated Value (USD) | Growth Rate (CAGR) |

| Satellite Internet Services | $18.5 Billion | 14.3% |

| Rural Connectivity Projects | $6.2 Billion | 16.7% |

| Maritime & Aviation Internet | $3.9 Billion | 11.2% |

What’s Fueling This Massive Growth?

- Remote Work and Digital Nomads: More people are working from anywhere—mountains, beaches, even RVs. They need reliable, fast internet.

- Rural Education and Development: Schools in remote areas rely on internet access for digital learning and global resources.

- Disaster-Ready Communication: Hurricanes, floods, and wars often knock out local networks. Satellites offer quick recovery and life-saving communication.

Starlink is positioned right in the middle of these fast-growing trends. Its low-latency, high-speed service is already filling the gaps that others can’t. With demand rising across homes, schools, military zones, and airplanes, Starlink’s growth potential is not just real—it’s massive.

Strengths and Advantages of Investing in Starlink Stock

If Starlink launches its IPO, it could become one of the most exciting investment opportunities in tech. The company is not just offering internet—it’s creating an entirely new way to connect the world using space-based technology. Backed by Elon Musk, it already has a strong reputation and massive growth potential. Its satellite network reaches places that no fiber line or tower can go. That gives Starlink a big edge over traditional and future competitors. Here are the top reasons investors might be eager to buy in:

First-Mover Advantage

Starlink is not just ahead—it’s in a league of its own. It has already launched thousands of satellites and serves millions of users globally. Its early start has allowed it to test, improve, and grow faster than rivals. Competitors like Amazon’s Project Kuiper are still in development, giving Starlink room to expand its lead. This head start could lead to long-term dominance.

Rapid Deployment and Scaling

One of Starlink’s biggest strengths is its ability to launch satellites quickly and at lower costs. SpaceX uses reusable rockets, which save time and money. This allows Starlink to add satellites regularly without relying on outside help. The more satellites it adds, the stronger and faster its network becomes. That makes global coverage not just a goal—but a realistic plan.

Strong Brand and Leadership

Elon Musk’s leadership is a major pull for many investors. He has already built massive success stories like Tesla and SpaceX. His name alone attracts media attention, public trust, and investment interest. With Musk leading the way, people believe Starlink can turn big ideas into real results. His vision creates confidence—and that matters when investing.

Recurring Revenue Model

Starlink runs on a subscription model, bringing in steady income each month. This is important for long-term investors because recurring revenue means predictability. Unlike one-time product sales, monthly payments build a strong financial base. This kind of stable cash flow is something many investors look for. It also gives the company room to invest in upgrades and expansion.

Government Contracts and Strategic Partnerships

Starlink isn’t just for homes—it’s being used by governments and military forces. It has signed deals with the U.S. Department of Defense, Ukraine, and other nations. These partnerships bring reliable income and prove that Starlink’s tech works in critical situations. Government backing also adds credibility in the global market. These contracts may help secure future expansion and financial security.

Risks and Concerns for Potential Investors

While Starlink looks promising, it’s important to look at the full picture. Every investment comes with risks, and Starlink is no exception. As a tech-driven, space-based company, it faces challenges that traditional telecom businesses don’t. From high costs to legal issues, investors need to understand what could go wrong. Knowing the risks helps you make a smart and balanced decision. Here are some key areas of concern:

Regulatory Risks

Different countries have different laws about satellite usage. Some governments, like China and Russia, are already restricting or rejecting satellite internet. Starlink must get approval to operate in each country it serves, which isn’t always easy. If large markets deny access, growth will slow. Regulatory delays can also hold back expansion and reduce profits.

High Infrastructure Costs

Launching and maintaining satellites is extremely expensive. Even with SpaceX’s lower launch costs, Starlink still needs billions for development. Equipment upgrades, repairs, and support systems also add to the spending. These high costs can affect profit margins and delay returns. Investors need to be patient and prepared for heavy spending in the early years.

Competitive Threats

Starlink’s lead isn’t guaranteed forever. Big players like Amazon and several Chinese companies are building their own satellite internet services. As more competitors enter the space, prices could drop and market share may shrink. Tech improvements from rivals could also challenge Starlink’s speed or reliability. Staying ahead won’t be easy in a fast-changing market.

Environmental and Ethical Concerns

Thousands of satellites orbiting Earth can create serious problems. Scientists have warned about space debris, collisions, and interference with astronomy. These concerns could lead to global restrictions or new laws limiting satellite numbers. Public and scientific backlash may affect Starlink’s future operations. Ethical concerns can also impact investor confidence.

IPO Timing and Valuation Uncertainty

There’s still no clear date for a Starlink IPO. If the launch is delayed, eager investors may have to wait longer than expected. On the other hand, if the IPO price is too high, early buyers could face losses. Valuing a company like Starlink is hard because it’s growing fast but spending a lot. The wrong timing or pricing could hurt retail investors.

Expert Investment Tips for Starlink Stock Enthusiasts

Getting excited about Starlink stock is easy, but smart investing takes more than hype. If the company goes public, buying shares blindly could lead to disappointment. That’s why experienced investors look beyond headlines and focus on facts. Timing, research, and planning all play a role in making the most of new tech stocks. Especially with a company like Starlink, preparation is everything. Let’s get some expert strategies to help you invest wisely when the opportunity comes:

Watch for IPO Filings and SEC Reports

Before any IPO, companies release an official document known as an S-1 filing. This gives a full look into the business, including its strengths and risks. For Starlink, this filing will reveal how much revenue it’s making, how fast it’s growing, and how much debt it carries. Reading this helps you understand the company’s real position. Don’t invest without knowing what’s under the hood.

Assess SpaceX’s Financial Health

Starlink isn’t on its own—it’s part of SpaceX. So if you want to invest in Starlink, it’s smart to understand how its parent company is doing. Look at SpaceX’s income sources, debts, and long-term goals. If SpaceX faces financial trouble, it could affect Starlink’s future. The two companies are tightly connected, so research both before buying.

Diversify Your Portfolio

Even the most promising stocks carry risk. Putting all your money into one stock—especially a new IPO—is risky. Instead, spread your money across different assets like tech giants, index funds, and dividend-paying companies. This way, if Starlink doesn’t perform as expected, your overall investments stay strong. Diversification protects you from market surprises.

Set a Budget and Entry Price

Don’t wait until IPO day to decide how much to spend. Plan your investment ahead of time and decide how much you’re willing to risk. Set a price range you feel good about and stick to it. IPO stocks often swing up and down quickly. Having a set budget will keep your decisions clear and emotion-free.

Use Limit Orders Instead of Market Orders

On IPO day, prices can move fast and unpredictably. A market order buys shares at whatever price is available—which could be higher than expected. A limit order lets you choose the maximum price you’re willing to pay. This gives you control and helps avoid surprises. It’s a safer way to invest in fast-moving IPOs.

How to Buy Starlink Stock When It Becomes Public

Buying Starlink shares, once the company goes public, will be simple if you’re ready. All you need is a basic setup with a trusted broker and a clear plan. Just like buying any other stock, there are a few steps to follow to make sure your purchase is smooth and safe. With the right approach, you can get in early and avoid common mistakes. Procedures of how to prepare and buy Starlink stock the smart way:

Open a Brokerage Account

If you don’t already have a brokerage account, now is the time to open one. Choose a reliable platform like Fidelity, E*TRADE, Robinhood, or Charles Schwab. These brokers make it easy to buy and sell stocks online. The sign-up process usually takes just a few minutes. Pick one that suits your needs and offers low fees.

Fund Your Account

Once your account is open, you’ll need to add money. You can transfer funds from your bank account to your broker securely. Make sure the transfer goes through before IPO day. It’s important to have the cash ready so you can act fast when the stock becomes available. Many brokers also allow you to set up alerts for new IPOs.

Research the IPO in Detail

Take time to learn everything you can about Starlink before buying. Read official documents, news articles, expert reviews, and financial statements. Look at the IPO price, how many shares will be sold, and what the company plans to do with the money. Knowing these details helps you invest with confidence and avoid hype traps.

Choose the Right Order Type

You’ll be asked to select an order type when buying.

- A limit order lets you decide how much you’re willing to pay per share. This is ideal when prices move quickly.

- A market order buys the stock right away, but you might pay more than expected.

For IPOs, most experts suggest using a limit order to stay in control.

Monitor the Stock After You Buy

It’s tempting to sell right away if the price jumps—but be careful. IPO stocks often rise fast and then drop just as quickly. Don’t panic if the stock dips in the first few weeks. Keep an eye on news, earnings, and market trends. If you believe in Starlink’s long-term mission, hold steady and focus on growth over time.

Starlink Stocks vs Other Space and Internet Stocks

Investors looking at Starlink often want to know how it compares to similar companies. While satellite internet is still a growing field, a few major players are already competing in this space. By comparing Starlink to others, we get a better idea of how far ahead it is—and how big the opportunity could be once it becomes public. Starlink offers more than just coverage; it offers scale, tech leadership, and unmatched reach. let’s know of how Starlink stacks up against top names in space-based connectivity:

| Company | Type | 2025 Valuation | Growth Focus | Publicly Traded |

| Starlink (via SpaceX) | Satellite Internet | Est. $80B | Global broadband | Not Yet |

| Amazon Kuiper | Satellite Internet | Est. $15B | Launch phase | No (Amazon-owned) |

| OneWeb | Satellite Internet | Acquired by Eutelsat | Focused on Europe | Yes (via Eutelsat) |

| Iridium | Satellite Telecom | $6.4B | Voice/data satellite use | Yes |

Long-Term Outlook: What Could Starlink Be Worth by 2030?

Looking ahead, Starlink could grow into one of the most valuable tech companies in the world. Its business model is scalable, its customer base is growing, and global demand for internet is still rising. Analysts believe that with the right strategy and support, Starlink’s valuation could more than double in the next five years. That would make it a major player not just in space—but in the entire tech sector.

Potential Forecasts by 2030

- User Base: More than 100 million global subscribers, including homes, businesses, and governments.

- Annual Revenue: Estimated between $50 to $70 billion, thanks to recurring monthly payments and enterprise deals.

- Valuation: Projected at $150 to $200 billion, if Starlink becomes its own company outside of SpaceX.

These numbers may seem big, but they’re built on current trends like rural internet growth, smart city development, and cloud-based global systems. If Starlink hits these goals, it could offer massive long-term returns for early investors.

Wrapping up

Investment on Starlink stock has the kind of potential that investors dream about. It’s bold, fast-growing, and backed by Elon Musk’s track record of big wins. If Starlink goes public soon, it could shake up the tech and telecom markets in a big way. But just like any fast-moving idea, there are risks that come with the rewards. Investing smart means watching the signs and knowing when to jump in.

So stay alert, do your homework, and follow Starlink stock journey closely. Big moves don’t happen every day—this could be one of them if you’re ready.

Frequently Asked Questions

Can I buy Starlink stock now?

No, Starlink is not publicly traded yet. It’s currently a part of SpaceX, which remains privately held. Some accredited investors have been able to buy pre-IPO shares of SpaceX via secondary markets, but retail investors must wait until a formal IPO announcement.

When will Starlink have its IPO?

While Elon Musk has hinted at a future IPO, no official date has been set. Industry insiders expect a possible IPO around 2026 once cash flow stabilizes. Investors should monitor SEC filings and media reports for updates.

Is Starlink a profitable company?

Currently, profitability is uncertain. While revenue is growing rapidly through subscriptions, costs related to satellite deployment and maintenance are still high. SpaceX has not disclosed detailed financials for Starlink alone.

How much could Starlink stock cost at IPO?

Analysts estimate an IPO valuation between $80 billion to $100 billion. If 1 billion shares are issued, the stock could start around $80–$100 per share. However, pricing is speculative until official documents are released.

Will investing in Starlink be risky?

Yes, like all emerging tech stocks, there are significant risks. Regulatory issues, competition, technological challenges, and reliance on Elon Musk’s vision all add uncertainty. It’s best suited for risk-tolerant investors.