Index Universal Life Insurance is a smart way to protect your loved ones while growing your savings. It offers lifelong coverage, combined with the opportunity to earn interest linked to the stock market’s rise. Unlike other insurance types, it lets you adjust premiums and build cash value over time. This flexibility makes it attractive to many people seeking security and growth. Understanding IUL can help you take control of your financial future.

Many want life insurance that does more than just provide protection. They want a plan that evolves and adapts to their changing needs. Index Universal Life stands out by offering this kind of adaptable coverage. It strikes a balance between safety and potential growth. This makes it a strong choice for those looking beyond basic policies.

What Does Index Universal Life Insurance Offer?

Index Universal Life Insurance is a permanent life insurance policy. It pays a death benefit to your family upon your passing. It also has a cash value part that grows over time. This cash value earns interest based on a market index, like the S&P 500. Your money is not directly invested in the stock market, so it’s safer.

You can choose to put part of your premiums into an indexed account. Some policies also allow you to deposit money into a fixed interest account. This way, you get a mix of growth and safety. IUL usually guarantees a minimum interest rate, so your cash value does not lose money if the market falls.

At the same time, the insurer sets a cap on how much interest you can earn. This means there is a limit to your gains during periods of strong market performance. But this cap also helps protect you from big losses. Overall, IUL balances growth with security for your savings.

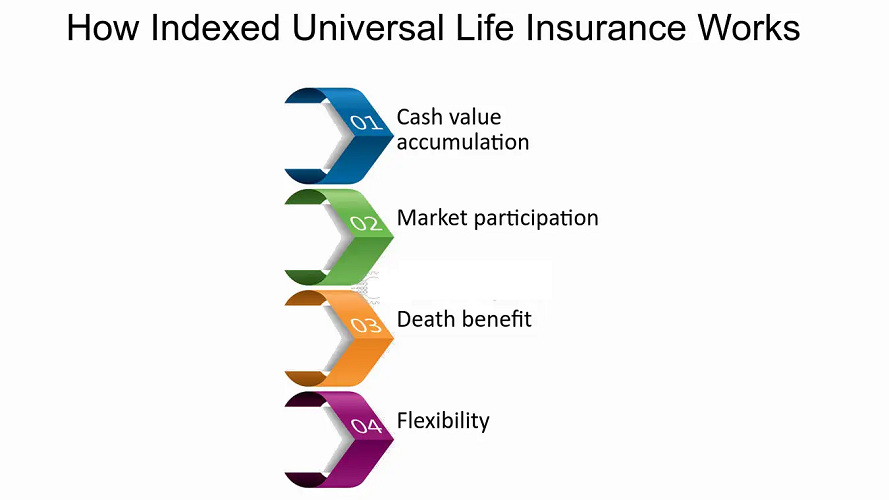

How Does Indexed Universal Life Insurance Work?

Indexed Universal Life Insurance works by combining life coverage with a savings component. When you pay your premiums, part of the payment goes toward the cost of your insurance, and the rest builds cash value. This cash value grows based on a stock market index, but your money isn’t directly invested. The insurer calculates interest credits using a special formula tied to the index’s performance. This approach offers potential growth while protecting your money from market losses.

- Cost of insurance: The part of your premium that pays for your Index Universal Life Insurance coverage.

- Fees &charges: These cover administrative costs and other policy fees.

- Cash value accumulation: The remainder of your premium that goes into your policy’s savings account.

- Interest crediting: Your cash value earns interest based on changes in a selected stock market index.

- No direct market investment: Your money is not invested directly in stocks but grows through credited interest.

Key Components of Indexed Universal Life Insurance Policies

Indexed Universal Life Insurance has several important parts that make it flexible and valuable. These features let you control how much you pay, how your money grows, and what happens after you pass away. The policy combines insurance protection with an account that can build cash value over time. Understanding these components helps you make smart choices about your coverage. Each part works together to balance risk, growth, and security.

Premium Flexibility

Premium flexibility allows you to adjust your payments as your budget changes. You might pay more when you have extra money or pay less if your finances are tight. The insurance company sets some limits, so you must meet minimum payments to keep the policy active. This option helps keep your coverage without financial strain. It gives you the freedom to manage your money while staying protected.

- Adjusting premiums allows you to control how much cash value accumulates.

- Paying more can increase your savings and death benefit.

- Lower payments might reduce growth, but keep your coverage.

- Flexibility is helpful during unexpected expenses or changes in income.

- You still need to check the minimum amounts to avoid policy lapses.

Death Benefit Options

IUL policies usually offer choices for the death benefit amount. You can select a fixed death benefit that stays the same for life. Or, you can choose an increasing death benefit, which adds your cash value to the payout. The growing option means your beneficiaries get more if your cash value grows. This option allows you to determine the amount of financial assistance your family will receive. It can be adjusted as your needs change.

- Fixed death benefit offers stable, predictable protection.

- The increasing death benefit grows with your cash value savings.

- The right option depends on your financial goals and family needs.

- Some policies allow switching between options over time.

- This feature helps tailor the policy to better fit your life.

Cash Value Growth

The cash value in an IUL policy can grow based on the performance of a stock market index. However, the insurer applies rules like participation rates, caps, and floors to control growth. The participation rate means that only a percentage of the index gain is added to your cash value. The cap rate limits the amount of interest you can earn, even if the market performs very well. The floor rate guarantees you won’t lose money if the index falls, usually by setting a minimum of zero percent.

- Growth depends on how the chosen index performs each period.

- Participation rates often range from 50% to 100%.

- Caps protect the insurer but also limit your top returns.

- Floors provide safety, so your savings don’t shrink during bad markets.

- These rules strike a balance between risk and reward in your policy’s cash value.

Loans and Withdrawals

You can take loans or withdrawals from your policy’s cash value when needed. Loans don’t usually cause taxes if managed well, but unpaid loans reduce your death benefit and cash value. Withdrawals lower the cash value and may have tax consequences if you withdraw earnings before the policy matures. Using these features allows you to access funds for emergencies, education, or other expenses without selling your investments. However, it’s essential to repay loans to maintain a good policy status.

- Loans provide flexible access to your policy’s cash value.

- Withdrawals reduce your savings and may affect your benefits.

- Taxes can apply if you withdraw more than what you put in.

- Using cash value avoids penalties typical in other savings accounts.

- Careful management helps maintain your Index Universal Life Insurance protection.

Benefits of Indexed Universal Life Insurance

Index Universal Life Insurance offers more than just a death benefit. It provides coverage that lasts your entire life, helping you protect your family and plan your future. The policy builds cash value over time, which can grow in line with market performance, while also providing safeguards. You can adjust your premiums and coverage to fit your changing needs. This kind of insurance can be a smart way to combine protection with savings.

Lifelong Coverage

IUL keeps your coverage active as long as you pay your premiums. Unlike term insurance, it does not expire after a set number of years. This permanent protection can support estate planning or leaving money to heirs. It ensures that your loved ones have financial support in the event of your passing. Lifelong coverage gives peace of mind for the future.

Potential for Cash Value Growth

Your cash value can grow based on how a stock market index performs. The money isn’t directly invested in stocks, so you avoid big risks. Interest credits are added based on index gains, which can help your savings increase over time. This growth can support loans or cover premiums in the future. It offers a way to build savings within your Index Universal Life Insurance.

Flexible Premiums and Death Benefits

You can adjust the amount you pay into the policy according to your financial situation. You can adjust your premiums within the allowed limits. The death benefit amount can also be adjusted to meet your family’s needs. This flexibility helps you manage costs and coverage as life changes. It’s a policy that adapts with you.

Tax Advantages

The money you earn in your cash value grows tax-deferred, meaning you don’t pay taxes until you withdraw. The death benefit is usually paid tax-free to your beneficiaries. This can make IUL more tax-efficient compared to other investment options. Tax benefits help your money work harder over time. It’s a smart way to save and protect your family.

Downside Protection

IUL policies guarantee a minimum interest rate, often zero percent, so your cash value does not lose money even if the market falls. This protects your principal from negative returns. While caps may limit gains, they also prevent you from losing cash value during market downturns. This safety net makes IUL less risky than direct stock investments. It helps keep your savings steady.

Access to Cash Value

You can borrow or withdraw money from your policy’s cash value when needed. This access can help with emergencies, education costs, or supplement retirement income. Loans usually don’t trigger taxes if managed properly. Using cash value is a flexible way to get funds without selling investments. It adds financial freedom while keeping your policy active.

Costs and Fees Associated with Indexed Universal Life Insurance

Knowing the costs associated with an IUL policy is crucial before purchasing. These costs affect how much your cash value grows and the total amount you pay. IUL tends to cost more than term insurance because it combines protection with savings. Understanding fees and charges helps you choose the right policy and avoid surprises. Being aware of expenses leads to better financial planning.

Premium Costs

IUL premiums are typically higher than those for term insurance. This is because you get lifelong coverage plus a cash value account. Paying more upfront means you can build more savings within the policy. Premiums may also vary based on your age and health. Budgeting for premiums is crucial to maintaining an active policy.

Cost of Insurance Charges

These charges cover the cost of the life insurance protection itself. They tend to increase as you get older. The cost of insurance is deducted from your premiums or your cash value account. It reflects the risk the insurer takes on covering you. Knowing these charges helps you understand the long-term costs of your policy.

Administrative Fees

IUL policies have fees to cover management and administrative expenses. These fees can reduce the growth of your cash value. They are usually taken from your premiums or deducted from the cash value. While necessary, high fees can impact your savings. It’s good to compare fees when choosing a policy.

Surrender Charges

If you cancel your policy prematurely, surrender charges may be applicable. These charges reduce the amount you get back from your cash value. They usually decline the longer you keep the policy. Understanding surrender fees is crucial if you anticipate terminating your policy early. It helps avoid losing money unexpectedly.

Caps and Participation Rates Impact Earnings

Caps limit the maximum interest your cash value can earn in good market years. Participation rates determine what portion of the index gains are credited to your account. While these protect the insurer, they also reduce how much you can earn. These limits can slow down your cash value growth over time. It’s essential to familiarize yourself with these rules before making a purchase.

Factors to Consider Before Buying an IUL Policy

Before choosing an IUL policy, think about your financial goals. Ask if permanent coverage and cash value growth are important to you. Check if you can afford the usually higher premiums over many years. Understand how caps and participation rates affect your cash value growth. Look closely at fees, since they can reduce your savings. Familiarize yourself with the rules for loans and withdrawals to avoid any surprises. Additionally, consider comparing other investment options, such as IRAs or 401(k)s, to determine if they better meet your needs.

- Define your long-term insurance and savings objectives.

- Ensure premium payments fit your budget comfortably.

- Learn how caps and participation rates limit earnings.

- Review all policy fees and administrative costs.

- Consider whether borrowing rules align with your financial plans.

How Does IUL Compare to Other Life Insurance Types?

Indexed Universal Life Insurance offers a mix of lifelong coverage and savings potential. However, it differs from other popular life insurance types. Each has its features, costs, and benefits. Understanding these differences helps you pick the best plan for your needs. Here’s how IUL compares to term life, whole life, and variable universal life insurance.

Indexed Universal Life vs. Term Life Insurance

Term life insurance covers you for a specific number of years. It does not accumulate any cash value, making it less expensive. However, term life insurance ends after the term expires, which means there is no coverage afterward. IUL offers coverage for your whole life with cash value that grows over time. This makes IUL more flexible but also more costly than term insurance.

- Term life insurance is ideal for temporary needs, such as mortgage or education costs.

- No cash value means lower premiums and simpler policies.

- IUL builds cash value you can borrow against or use later.

- IUL coverage lasts as long as premiums are paid, unlike term life.

- Choosing depends on whether you want permanent protection or short-term coverage.

Indexed Universal Life vs. Whole Life Insurance

Whole life insurance offers steady premiums and guaranteed cash value growth. It provides a guaranteed death benefit and predictable costs over time. IUL policies give more flexibility in premiums and death benefits. They also tie cash value growth to a market index, which can offer higher returns but less certainty. Whole life suits those wanting stable, simple plans. IUL appeals to people who want growth potential and adjustable features.

- Whole life guarantees fixed premiums and growth rates.

- IUL premiums and death benefits can be changed within limits.

- IUL cash value growth depends on market performance with some protection.

- Whole life policies are often easier to understand.

- Both offer permanent coverage but different levels of flexibility.

Indexed Universal Life vs. Variable Universal Life Insurance

Variable Universal Life lets you invest your cash value directly in mutual funds or other investments. This offers higher growth potential but comes with more risk. IUL credits interest based on an index but does not invest your money directly in the market. This means less risk and downside protection. Variable universal life insurance is best suited for individuals who are comfortable with investment risks. IUL suits people wanting market-linked growth with safety nets.

- Variable universal life policies have higher risk and reward.

- IUL limits losses with minimum interest rate guarantees.

- Both policies offer premium and death benefit flexibility.

- Variable universal life requires more active management.

- IUL provides more predictable growth with market participation.

Factors to Consider Before Buying an IUL Policy

Before choosing an IUL policy, think about your financial goals. Ask if permanent coverage and cash value growth are important to you. Check if you can afford the usually higher premiums over many years. Understand how caps and participation rates affect your cash value growth. Look closely at fees, since they can reduce your savings. Familiarize yourself with the rules for loans and withdrawals to avoid any surprises. Additionally, consider comparing other investment options, such as IRAs or 401(k)s, to determine if they better meet your needs.

- Define your long-term insurance and savings objectives.

- Ensure premium payments fit your budget comfortably.

- Learn how caps and participation rates limit earnings.

- Review all policy fees and administrative costs.

- Consider whether borrowing rules align with your financial plans.

Wrapping up

Index Universal Life Insurance offers more than just a death benefit. It helps your money grow safely while keeping your family protected. Its flexible features allow you to adjust payments and benefit amounts when needed. This makes IUL a smart choice for people seeking both security and growth. Knowing its benefits and costs helps you make informed decisions.

Choosing the right insurance is a key part of financial planning. IUL offers options that adapt to your changing life. It can be a valuable tool for building wealth and protecting your family. With its mix of safety and growth potential, it stands apart from other life insurance types.

FAQs about Indexed Universal Life Insurance

What is Indexed Universal Life Insurance?

Indexed Universal Life Insurance (IUL) is a permanent life insurance policy. It offers lifelong protection, along with a savings feature known as cash value. This cash value grows based on the performance of a stock market index but is protected from losses. IUL offers flexibility with premiums and death benefits, distinguishing it from other insurance types.

How does the cash value grow in an IUL policy?

The cash value in an IUL policy grows by earning interest linked to a stock market index like the S&P 500. However, your money is not directly invested in the market. The insurer credits interest based on index changes with caps and participation rates. This helps your savings grow while protecting your cash from market downturns.

Can I adjust my premiums and death benefit with IUL?

Yes, one key benefit of IUL is flexibility. You can adjust your premium payments within certain limits. You can also adjust the death benefit amount to suit your family’s needs. This makes IUL a customizable option for people with changing financial situations.

What are the risks associated with Indexed Universal Life Insurance?

While IUL offers downside protection, there are some risks to consider. Caps and participation rates limit how much your cash value can grow, so gains might be smaller than expected. Also, fees and insurance costs can reduce cash value growth. It’s essential to consider these factors before purchasing a policy.

How does IUL compare to term life insurance?

Term life insurance covers you for a set time and usually costs less but has no cash value. IUL provides lifelong coverage with a cash savings feature but at a higher premium. Term life insurance is suitable for temporary needs, while IUL suits those seeking permanent protection and potential cash growth.